SINGAPORE — Asian markets were mixed Tuesday in narrow trading on doubts that U.S. and China can manage to resolve their festering trade dispute.

Keeping Score

Thailand’s SET dropped to 1,638.07, a 0.7 percent decrease, on Tuesday afternoon. Japan’s benchmark Nikkei 225 lost 0.3 percent to 21,148.02 while South Korea’s Kospi added less than 0.1 percent to 2,054.48. Hong Kong’s Hang Seng was almost 0.1 percent lower at 25,741.07. The Shanghai Composite rose 0.1 percent to 2,587.88. Australia’s S&P/ASX 200 added 0.4 percent to 5,575.90. Shares rose in Taiwan but fell in Singapore, Indonesia and Thailand.

Wall Street

Buying by technology companies spurred gains for U.S. indexes after steep losses in early trading. China has protested the detention of a Chinese technology executive in Canada, which was carried out at the request of the U.S. The S&P 500 index rose 0.2 percent to 2,637.72 and the Dow Jones Industrial Average added 0.1 percent to 24,423.26. The technology-heavy Nasdaq composite rose 0.7 percent to 7,020.52. The Russell 2000 index of smaller-company stocks dropped 0.3 percent to 1,443.09.

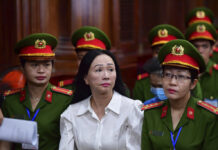

US-China Relations

U.S. Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He have talked about “the promotion of the next economic and trade consultations,” a statement by the Chinese Commerce Ministry said Tuesday. It did not elaborate. This indicates that the arrest of Meng Wanzhou, the chief financial officer of Chinese telecommunications giant Huawei, in Canada will not derail trade talks. Meng is wanted in the U.S. for allegedly misleading banks about the company’s business dealings in Iran. Still, traders fear a 90-day tariffs cease-fire may not be enough for the countries to resolve deep-seated issues. China has protested the arrest and told the U.S. and Canada that it would take further steps based on their response. A bail hearing for Meng is underway in Vancouver, British Columbia.

Softer Asian Growth

On Monday, revised data showed that the Japanese economy shrank by a worse-than-expected 2.5 percent in the third quarter, partly because of natural disasters. Over the weekend, China reported that its exports and imports slowed in November, adding to concerns that its economy may slow further, sapping regional and global growth.

Analyst’s Take

“Early movers in the Asia region had commenced with a brisker tone following the U.S. lead, although the awareness that the macro picture remains unchanged seems to have tamed some of the delight,” Jingyi Pan of IG said in a market commentary.

iPhone Ban in China

On Monday, U.S. chipmaker Qualcomm said it won an order in a Chinese court banning sales of some Apple phones in China. This is part of a lengthy dispute over two Qualcomm patents allowing users to format photos and manage phone apps using a touch screen. Although Qualcomm said the ban applies to models of the iPhone 6S through X, Apple said all iPhones will remain available for customers in China. Qualcomm shares jumped 2.2 percent to USD$57.24 on the news.

Energy

Oil prices slipped Tuesday following a sharp decline. They have erased their gains from news of a production cut by OPEC countries and other major oil producers. U.S. benchmark crude lost 4 cents to $50.96 a barrel. It gave up 3.1 percent to $51 a barrel in New York on Monday. Brent crude, used to price international oils, shed 10 cents to $59.87. The contract dropped 2.8 percent to $59.97 a barrel in

Currencies

The dollar weakened to 113.14 yen from 113.34 yen late Monday. The euro rose to $1.1361 from $1.1355.

Story: Annabelle Liang